Tally vs Go GST Bill – Which GST Billing Software Is Right for Your Small Business?

As a small business owner in India, your time is best spent growing your business—not struggling with complicated billing software. When it comes to choosing between Tally and Go GST Bill, the difference often comes down to simplicity, accessibility, and how well the software aligns with your daily business needs.

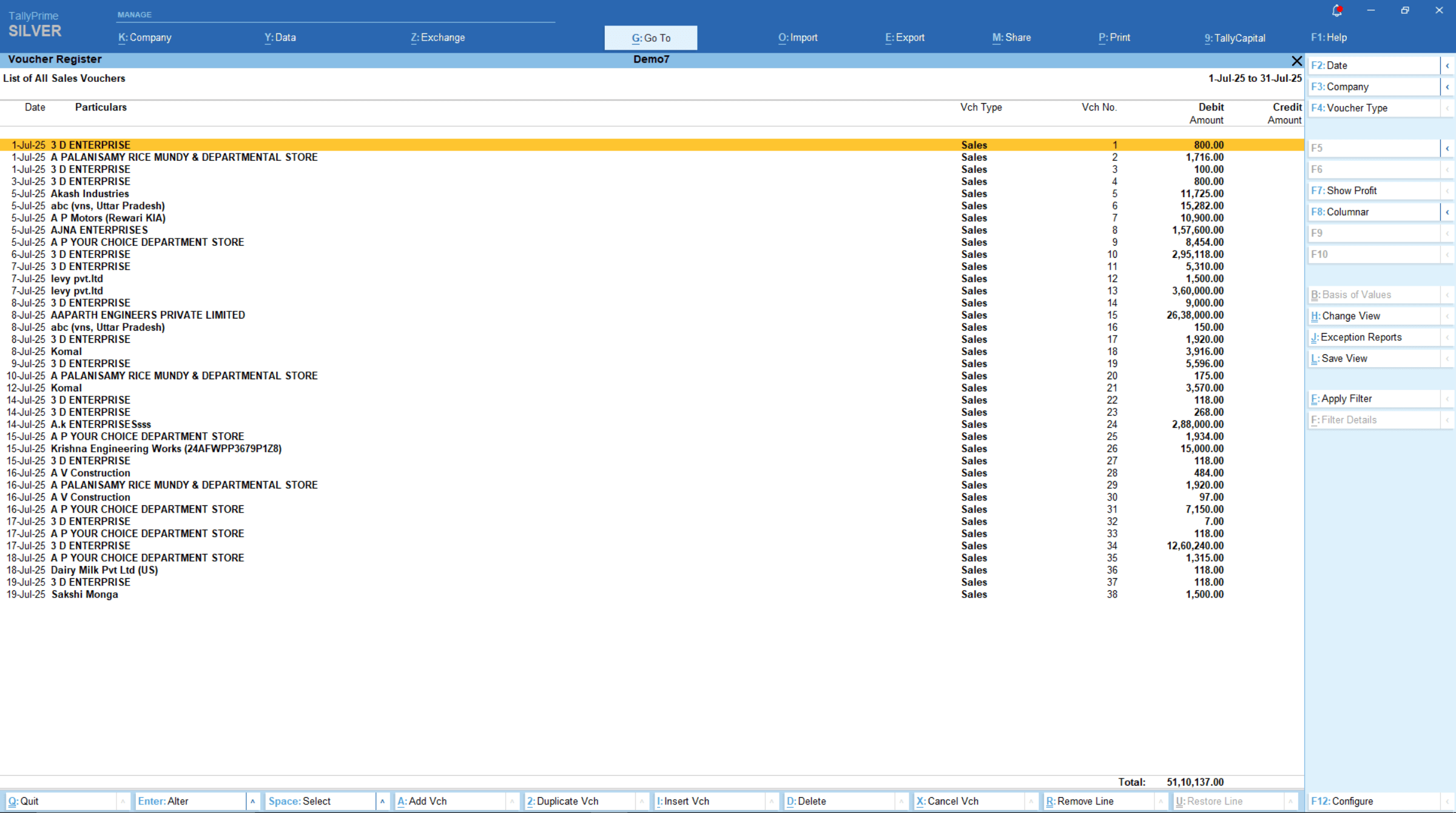

Tally: Powerful, but Not Always Practical

Tally has been a trusted name in accounting software for years. It's a powerful tool, especially for businesses with professional accountants or CAs. However, its structure and interface are designed for users familiar with complex accounting workflows—ledgers, vouchers, journal entries, and bulk manual configurations.

Without proper training or background knowledge, Tally can feel overwhelming especially for first-time users or small business owners managing everything on their own.

Go GST Bill: Built for Everyday Businesses

Go GST Bill is a smart, cloud-based billing solution built especially for Indian small businesses. Whether you're a retailer, wholesaler, freelancer, or service provider you can start billing in minutes. There’s no steep learning curve.

Its clean, intuitive interface doesn’t require accounting knowledge. Just open the app (desktop or mobile) and get going.

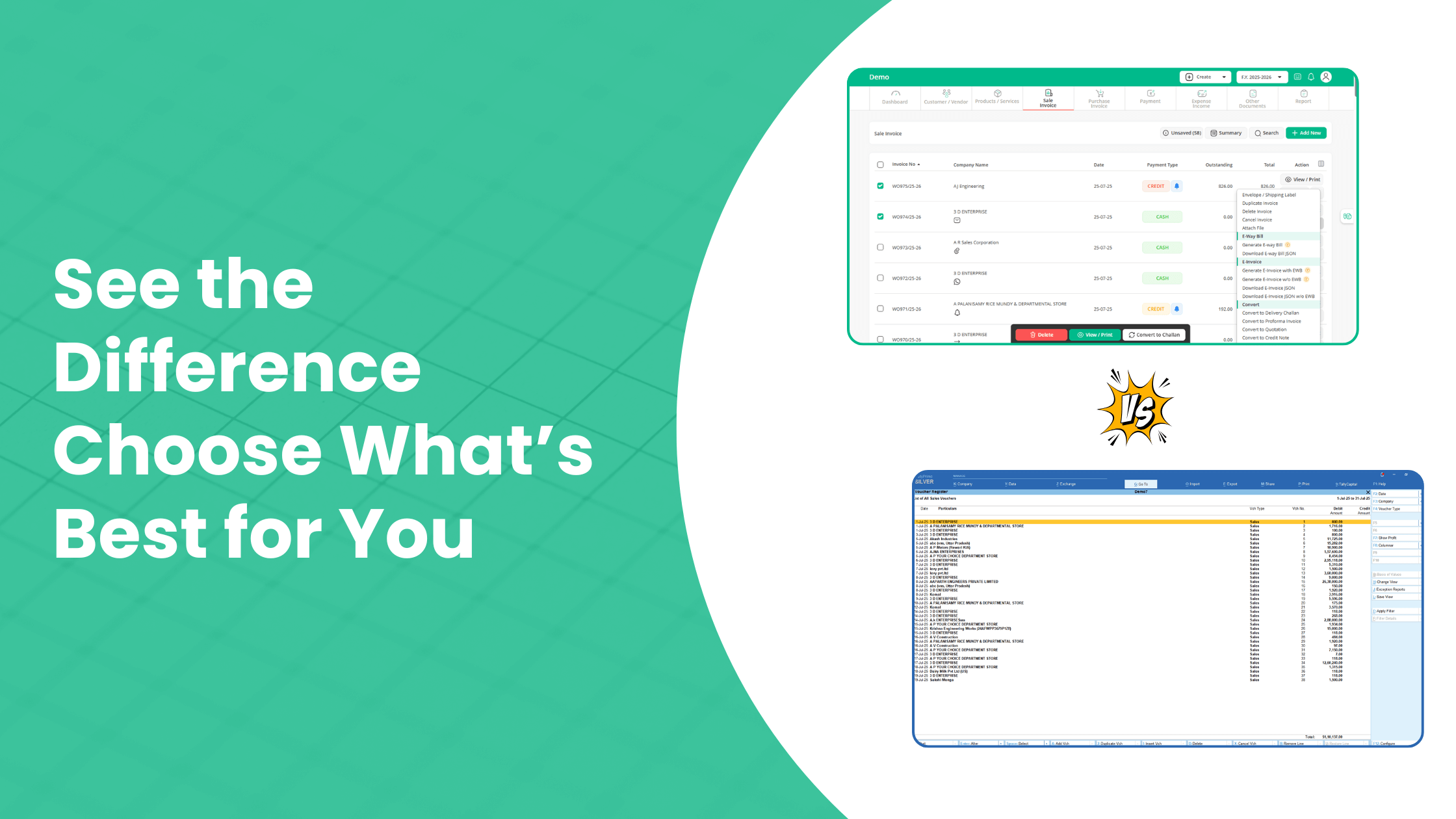

Tally vs Go GST Bill – Discover the Difference

We have compared the user interface of both software, and the following points highlight how Go GST Bill is easier to use and simplifies everyday billing tasks.

While similar outcomes might be possible with Tally, achieving them requires proper training and manual configuration, making it less accessible for non-technical users.

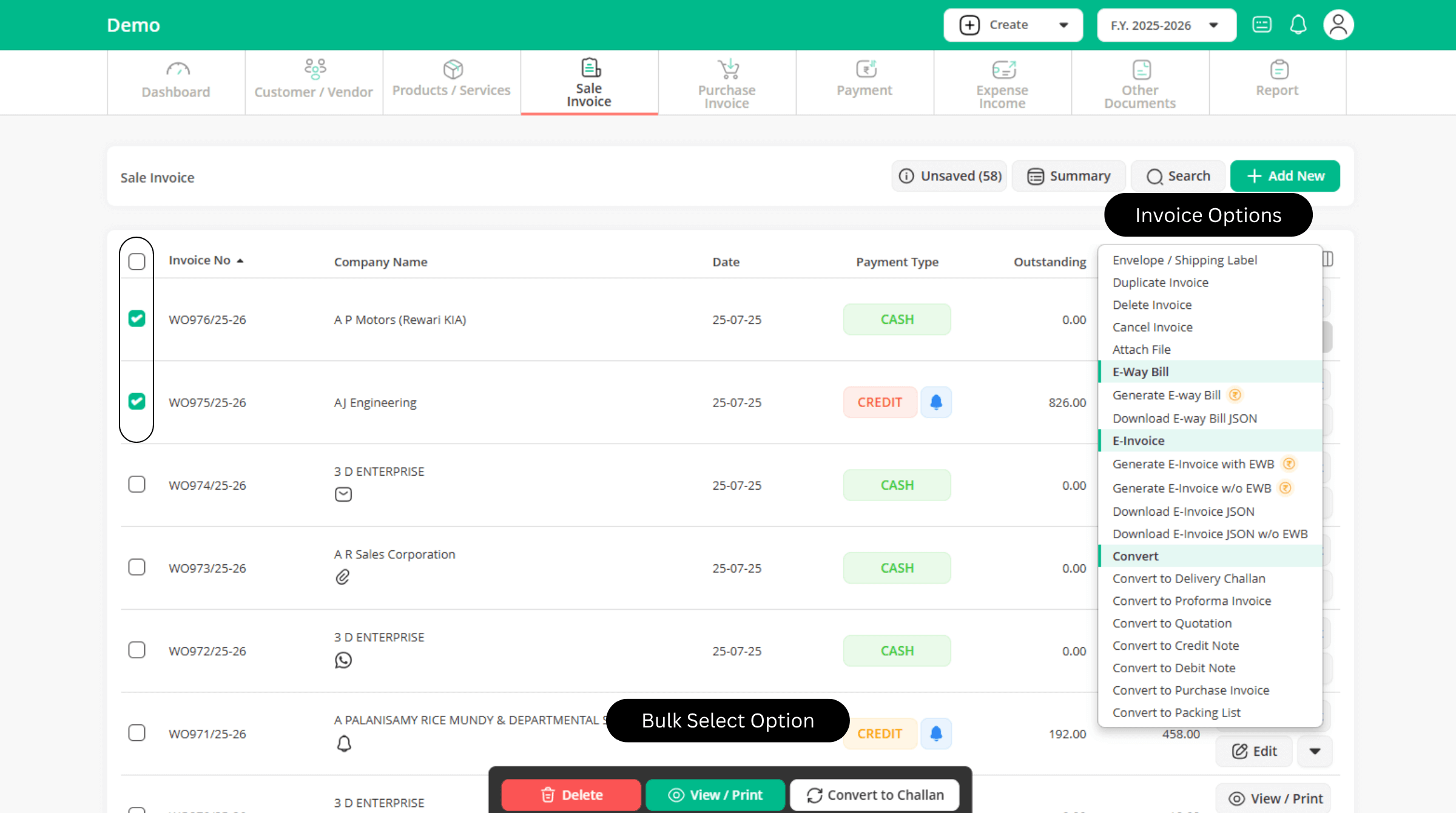

1. Bulk Action

In Go GST Bill, you can select multiple invoices at once and quickly perform bulk actions like Print, Convert to Challan, Send via Email, or Share on WhatsApp — saving your time and boosting productivity.

2. Invoice Activity

Each invoice shows a clear activity log on-screen: whether it was sent on WhatsApp or email, if a payment reminder was issued, if files were attached, or if it was converted into another format like a proforma. Everything is visible at a glance.

3. Easy Payment Tracker

Go GST Bill makes payment tracking simple with color-coded statuses — Green for paid, Yellow for partially paid, and Red for unpaid. The status is clearly visible on screen and easy to understand at a glance — so you always know where your money stands.

4. Payment Reminder

Unpaid invoices show a bell icon directly in the payment column. Just click the icon to instantly send a reminder via Email, WhatsApp or SMS —no need to go to a separate screen or create a manual message.

5. Easy Sharing Options

You can share invoices directly using the “View & Print” button—choose to send it via WhatsApp, email, or simply download the PDF. No extra setup required.

6. 1-Click Actions

Just click the Down Arrow button beside the edit button and almost every major function— E-Way bill, E-Invoice, Convert, Duplicate, Envelope or Shipping Label — is available with just one click. There’s no need to search for features or go through multiple screens.

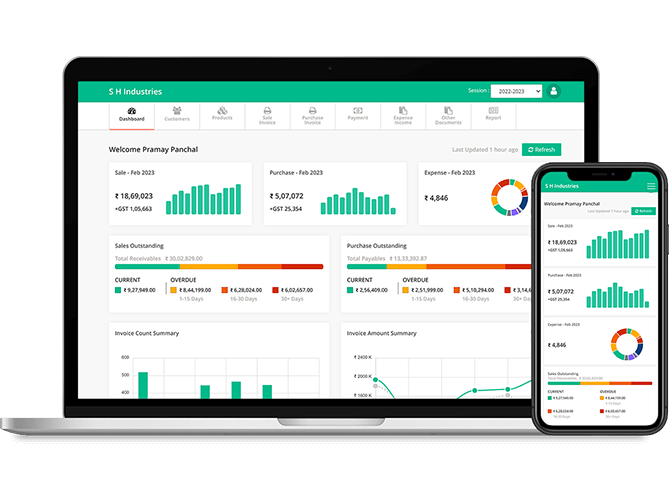

7. Mobile-Friendly and No Extra Setup and Cost

Everything you do on the desktop, you can do on your phone—without needing to pay anything extra or go through a separate setup.

Go GST Bill is a smart, modern GST invoicing solution designed for real life business use. You can manage billing from your shop, home, or even while traveling without needing professional help.

If your business doesn’t have an accountant or if you’re simply looking for easy, reliable GST billing Go GST Bill is the clear winner. It’s made to save you time, cut down on effort, and keep your business GST-compliant without the usual headaches.

At the end of the day, your software should work for you—not the other way around.