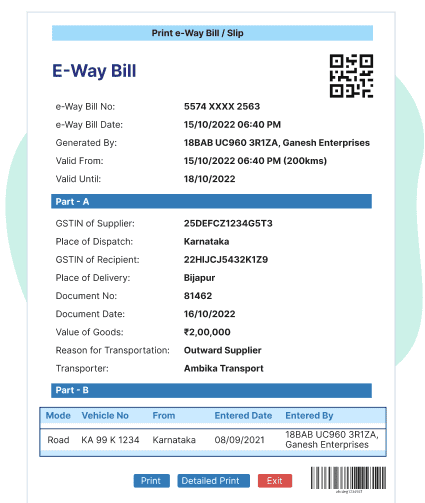

An E-Way bill is a document required for inter-state and intra-state transportation of goods with a value exceeding Rs. 50,000. It includes details of the goods, the consignor, the transporter and the recipient.

E-Way bill is an electronic system developed to monitor the transport of goods and ensure compliance with the GST law, aimed at reducing tax evasion.

The person generating an E-Way bill must be registered on both GST and E-Way bill portals.

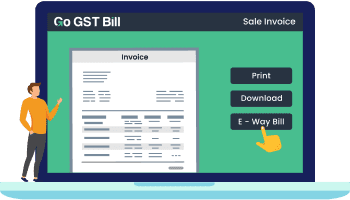

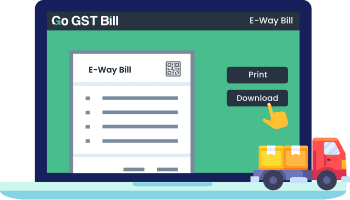

After creating invoice you will see a button to generate E-Way bill, Its very easy just click that button and you are done. it will generate your E-Way bill very quickly and automatically add E-Way bill no on your invoice. You can also download and print your E-Way bill from Go GST Bill.

Go GST Bill E-Way bill software offers numerous advantages. It is easy-to-use cloud-based software that enables you to generate and print E-Way bills in just 1-click without going to the GST E-Way bill portal. It enables you to generate GST compliant E-Way bills in less than 10 seconds. It is a secure E-Way bill solution for all your E-Way bill compliances.

No, an E-Way bill cannot be edited after creation. Although you can update Part B. However, if an E-Way bill is generated with incorrect information, you can cancel it within 24 hours and generate it afresh.

Yes, you can cancel the E-Way bill but only within 24 hours of creation. We make it easy for you to cancel an E-Way bill with just 1 click.

No, once you are registered on the GST E-Way bill portal and link it with the Go GST Bill account, you don’t have to go to the E-Way bill portal every time you generate an E-Way bill. Our software will help you generate and print E-Way bills in just 1 click without going to the E-Way bill portal.

Yes, you can share the E-Way bill with your customers on WhatsApp, by email or as an invoice link.