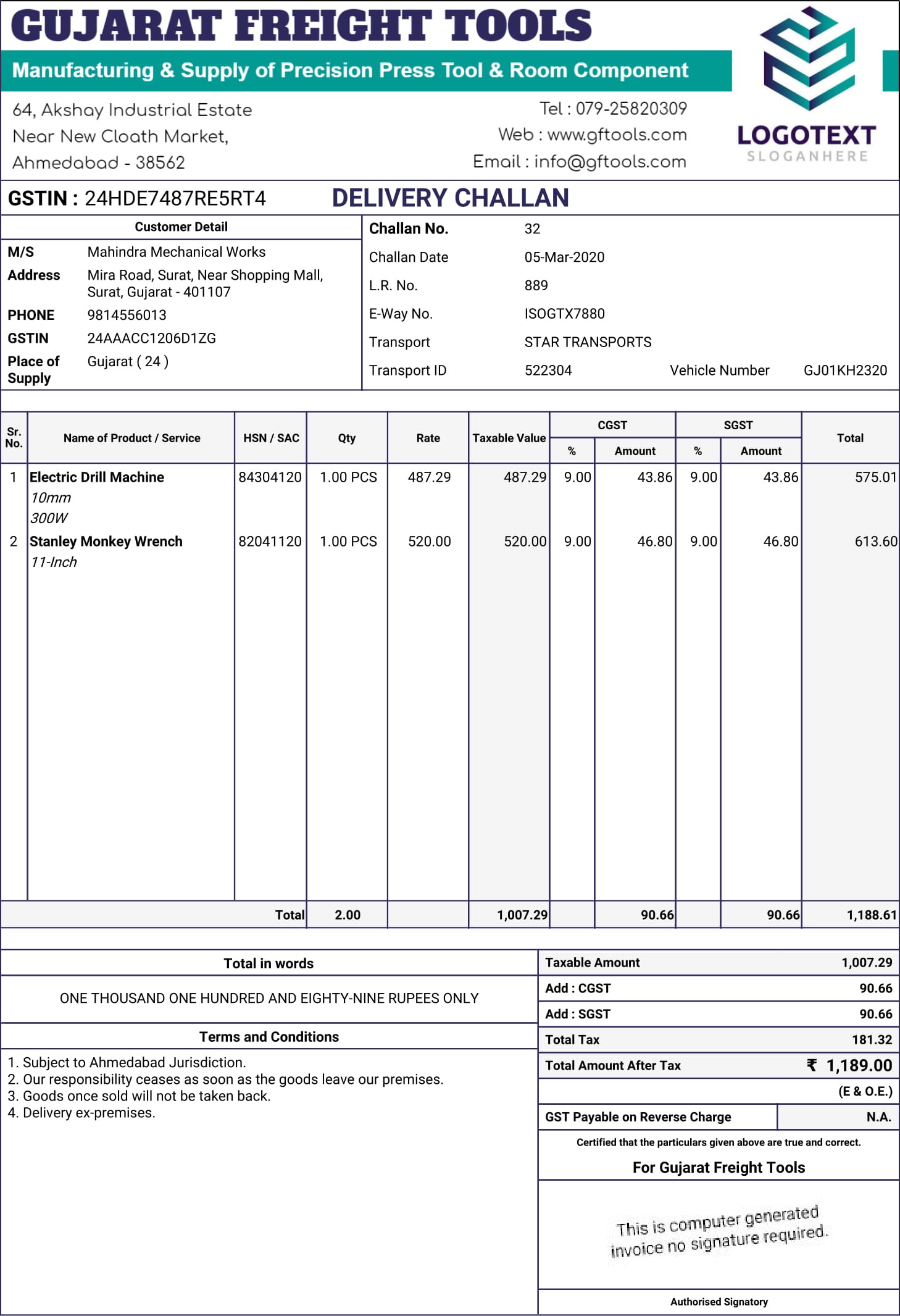

GST delivery challan is a document generated during the supply of goods or services from place to another, regardless, there will be a sale or not. This challan is sent during the shipping of products. In some circumstances, the GST delivery challan considers a sufficient document for the shipping of goods.

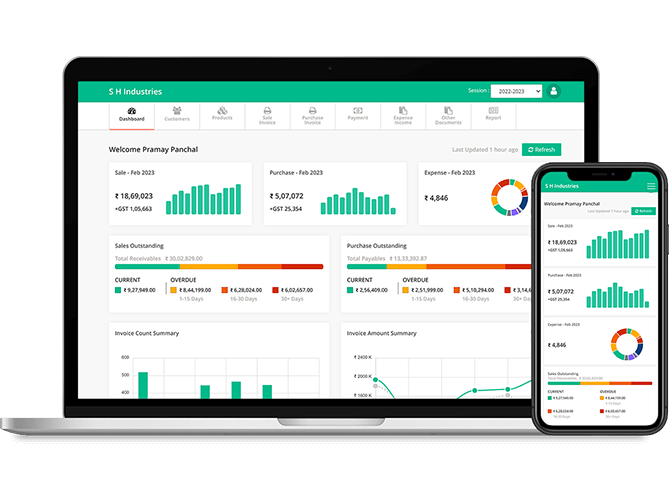

With GoGSTBill billing software, you can easily create a GST Delivery Challan with just a few clicks. Click here to create your account in GoGSTBill billing software.

The Perfect GST Challan Format for Hassle-Free Transportation of Goods

Under the GST Act in India, a registered business enterprise cannot move their sold goods and services without a tax invoice. There are times when goods are moved from a place to another without selling, mainly for quality checks and storing purposes. In this situation, a tax invoice is not necessary but a delivery challan. Our invoice software can provide you with the best GST challan format. A delivery challan also is prepared to confirm delivery during the sale of goods. A GST Challan format is required for it. The customer signs on it to approve the delivery of goods purchased. It is different from an invoice. A delivery challan format GST help you to abide by the rules of GST.

A delivery challan format will include the name and address of the seller and the buyer, date and challan number, item description with code, number of goods, taxable value and tax rate, the total amount to pay and delivery destination. Our online billing software has many challan formats and you can choose according to your needs and preferences.