Once the E-Way Bill is generated in Go GST Bill software, you can easily extend its validity in case the delivery gets delayed.

🚚 Common situations when extension is needed:

- Natural Calamity – Delay due to weather conditions, floods, landslides, etc.

- Law & Order – Issues like curfew, strikes, bandh, roadblocks, or government restrictions.

- Transhipment – Delay during shifting of goods from one vehicle to another (like at a transport hub).

- Accident – Vehicle accident causing delay.

- Other – Any other reason not covered above (e.g., vehicle breakdown, driver unavailability, operational delays).

🛠️ Steps to extend E-Way Bill in Go GST Bill:

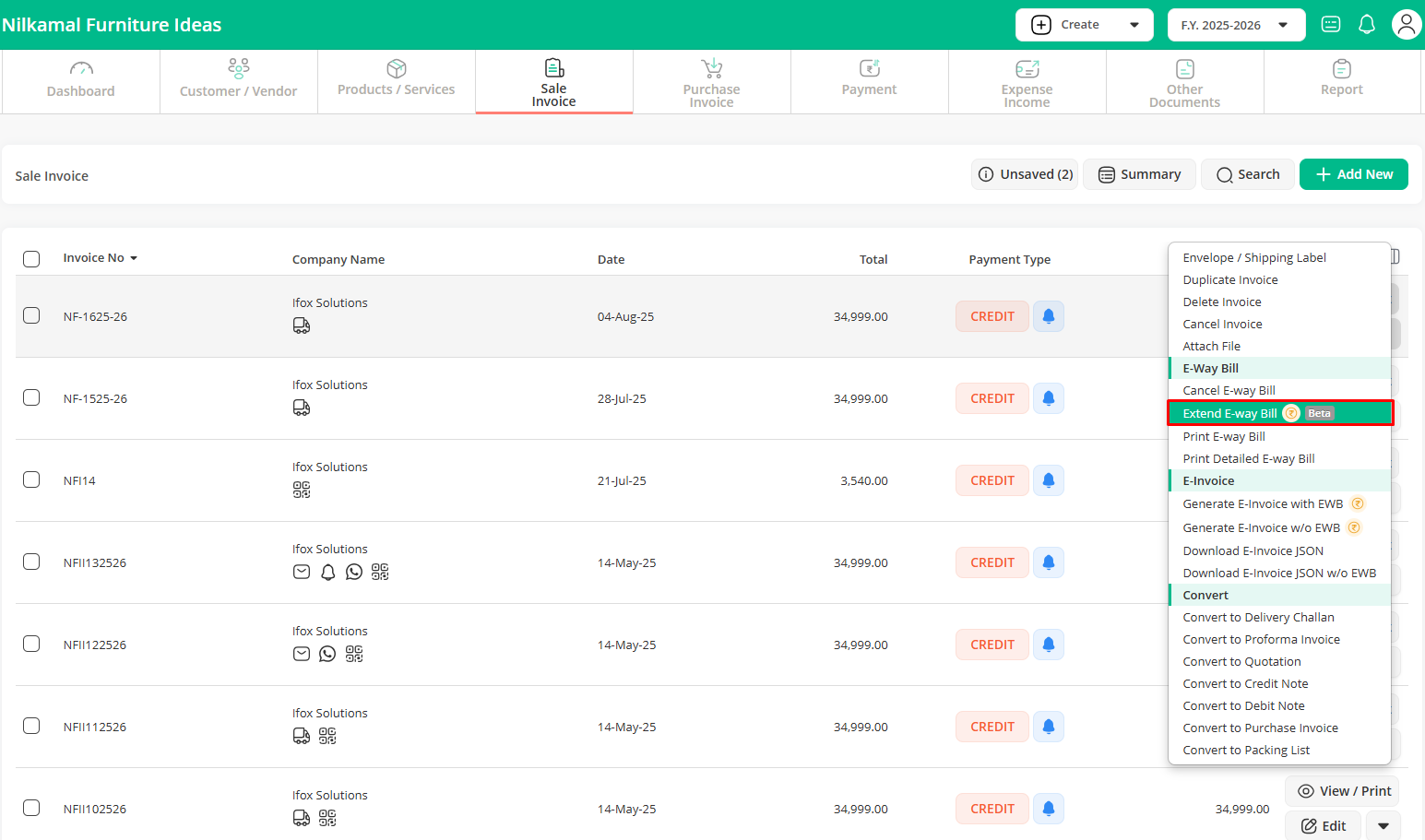

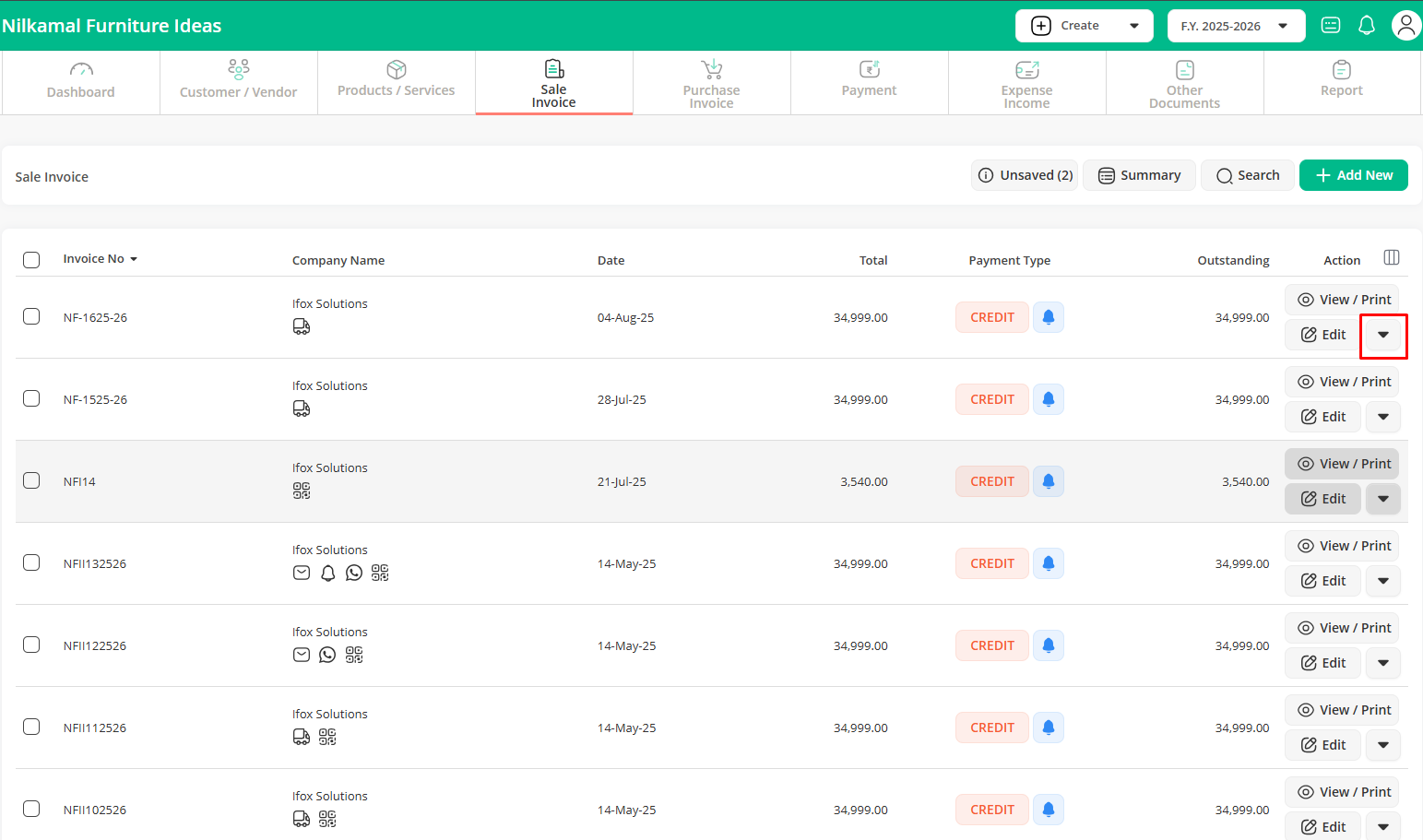

Step 1: Go to the “Sales Invoice” menu and find the invoice for which you want to extend E-Way Bill and Click on the dropdown arrow next to it.

Step 2: Click on the “Extend E-Way Bill” option.

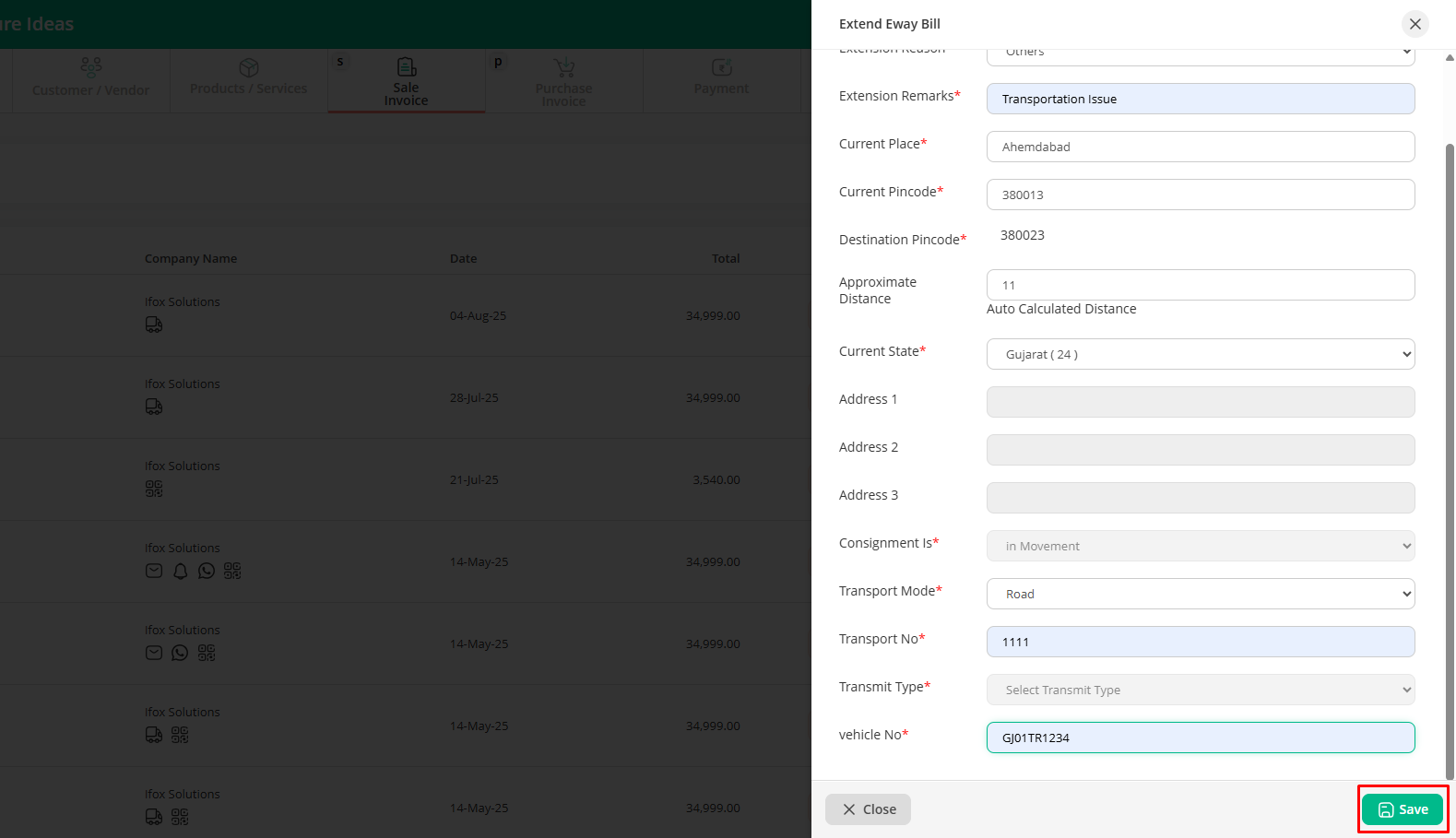

Step 3: A pop-up window will appear, fill in the required details and then click on “Save”.

📝 Note: Make sure to extend the E-Way Bill before it expires (within 8 hours of expiry), and only if goods are still in transit.