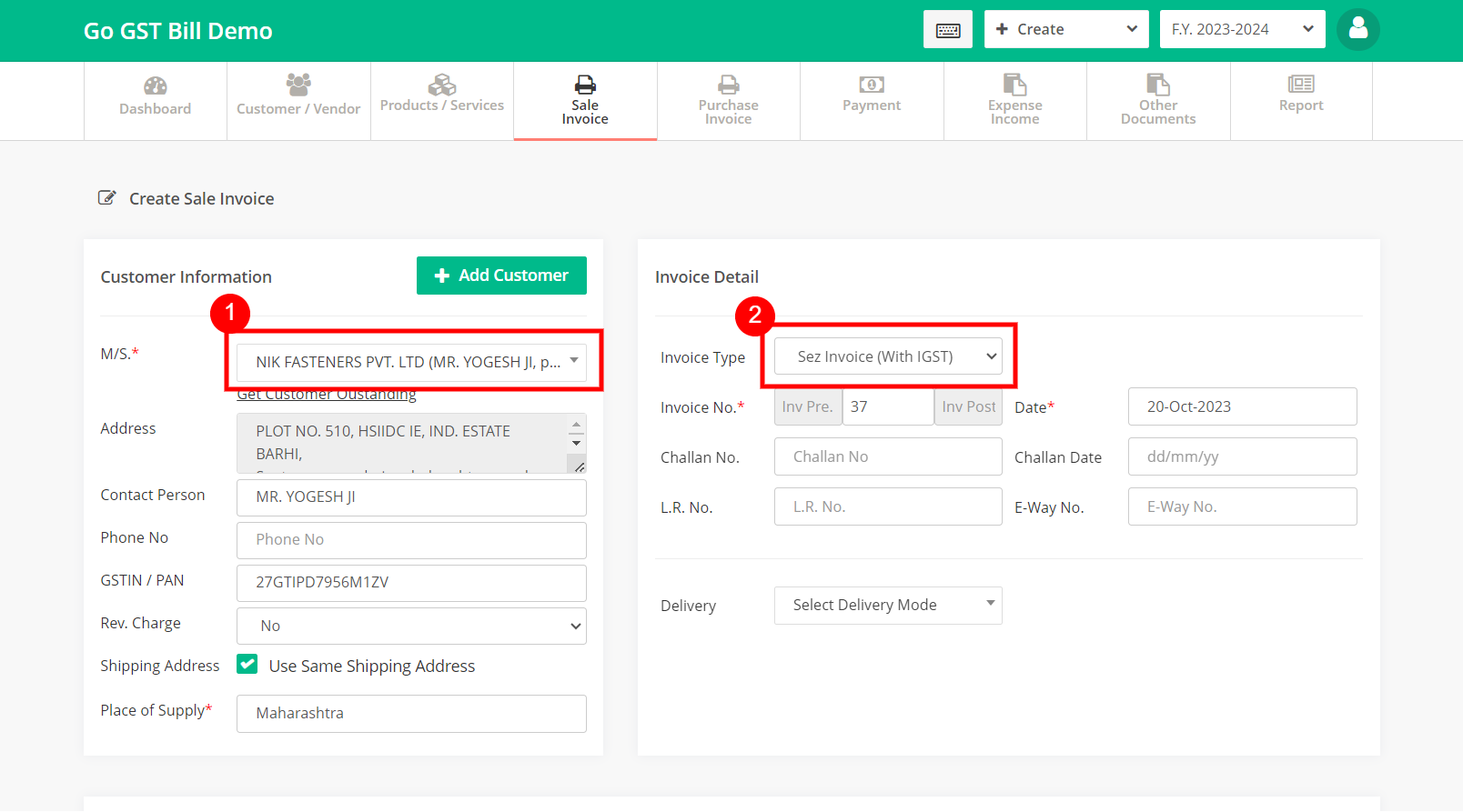

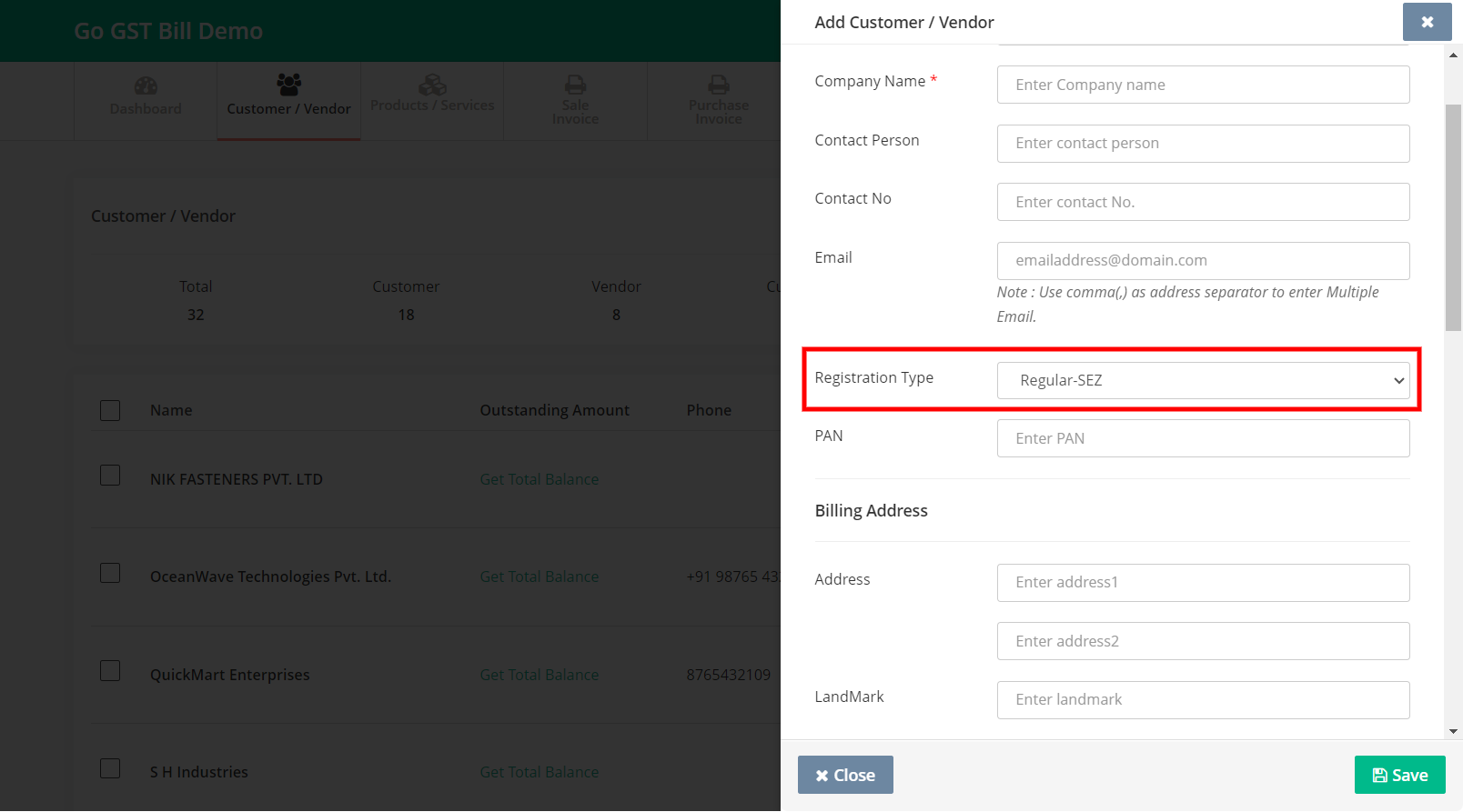

When adding a customer If you have selected the registration type as “Regular-SEZ” then while creating the invoice for that customer you will see option “Sez Invoice (With GST)” and “Sez Invoice (Without GST)” under Invoice Type, See below

– Your customers registration type should be “Regular-SEZ”

– While creating the invoice for that customer you will see option “Sez Invoice (With GST)” and “Sez Invoice (Without GST)” under Invoice Type

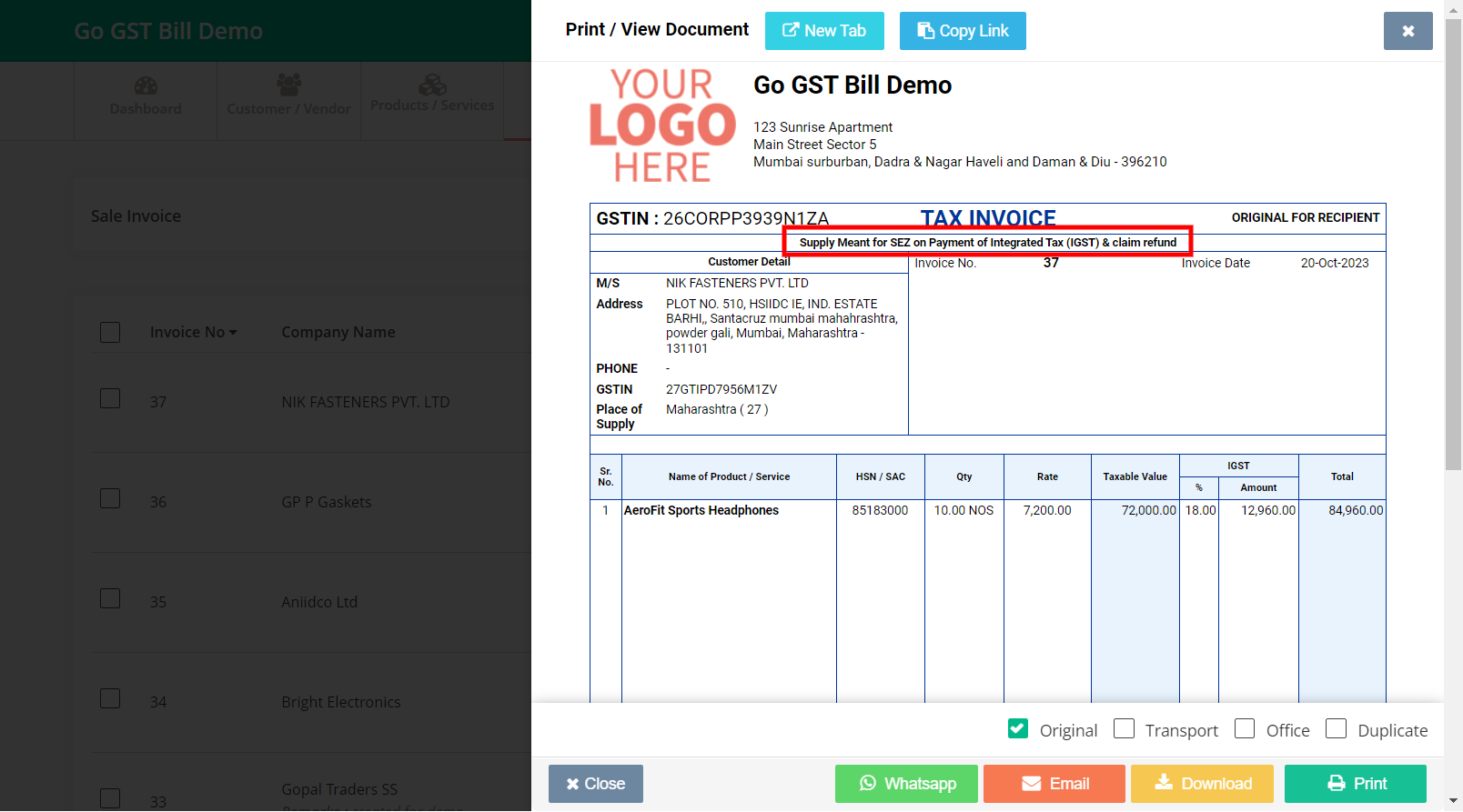

– You will see SEZ note on your invoice print