A debit note is issued under various circumstances, including Goods Returns, Discount After Sale, Corrections In Invoice.

There are 2 methods to create debit note in Go GST Bill, See below

Method 1:

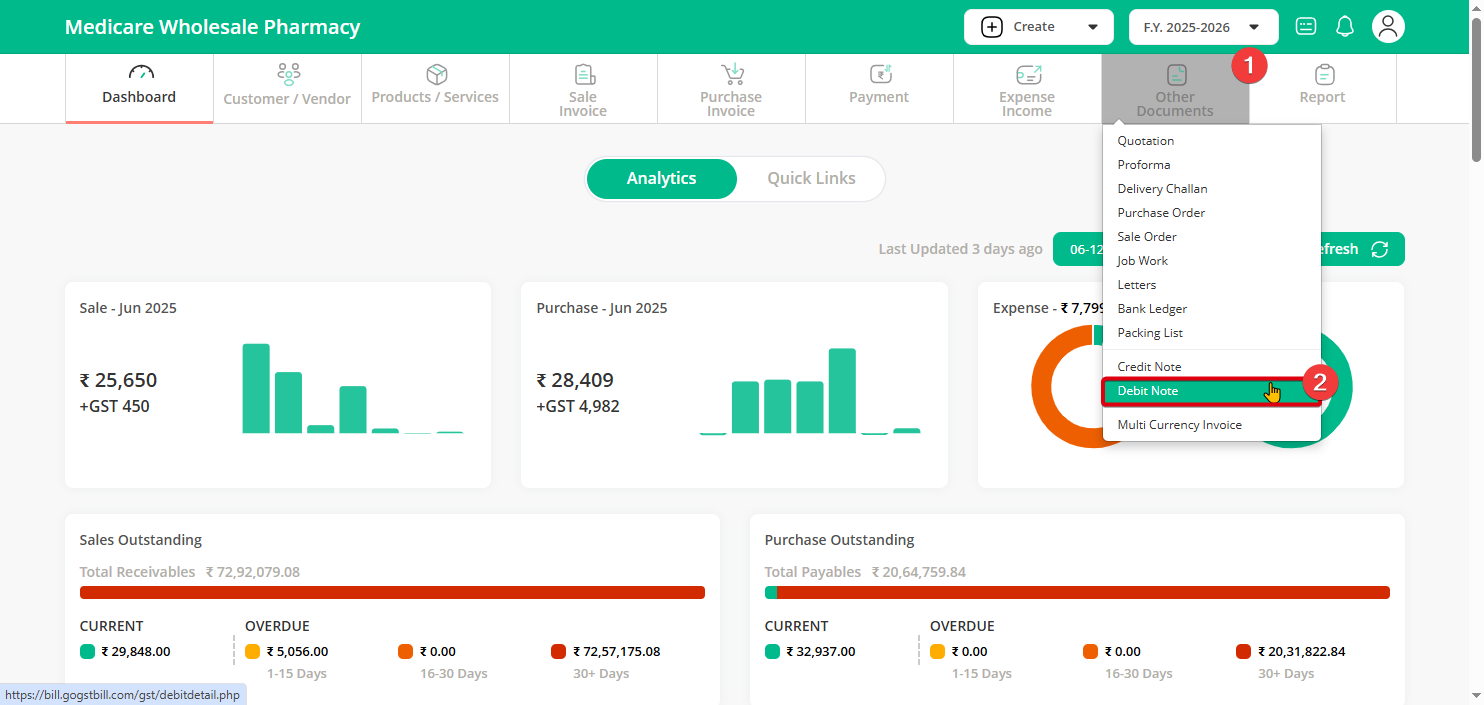

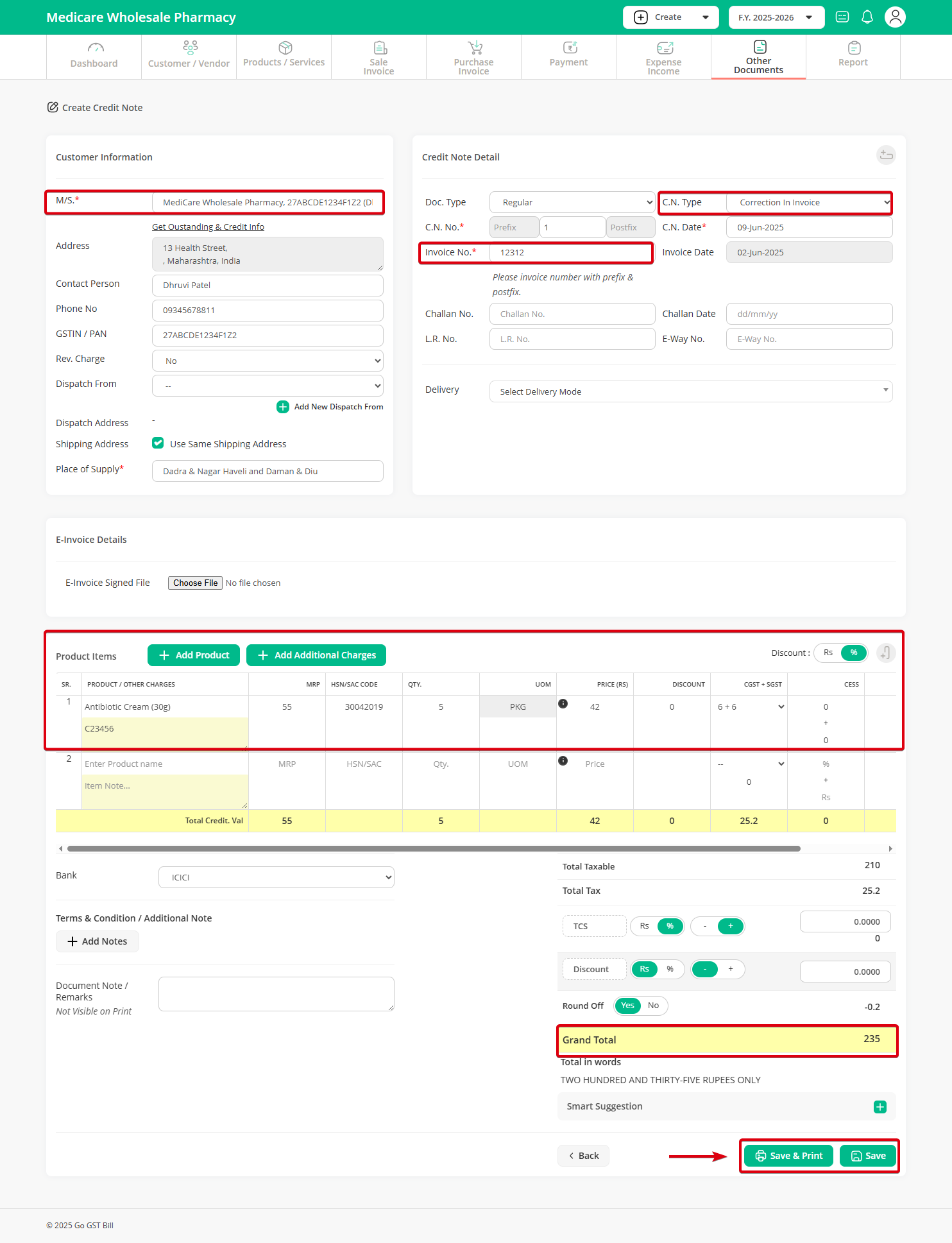

Step 1: Click on other document menu then click on debit note sub-menu.

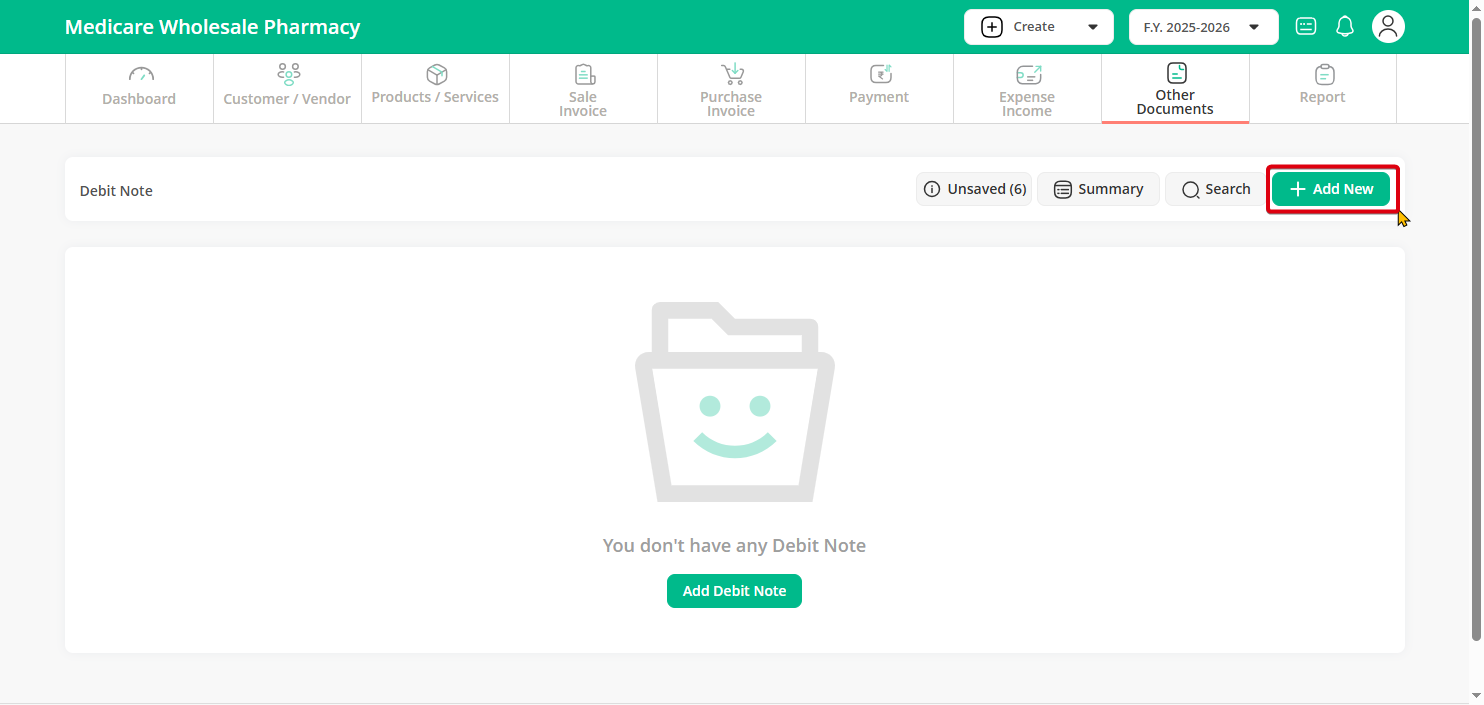

Step 2: Click on “Add New” Button.

Step 3:

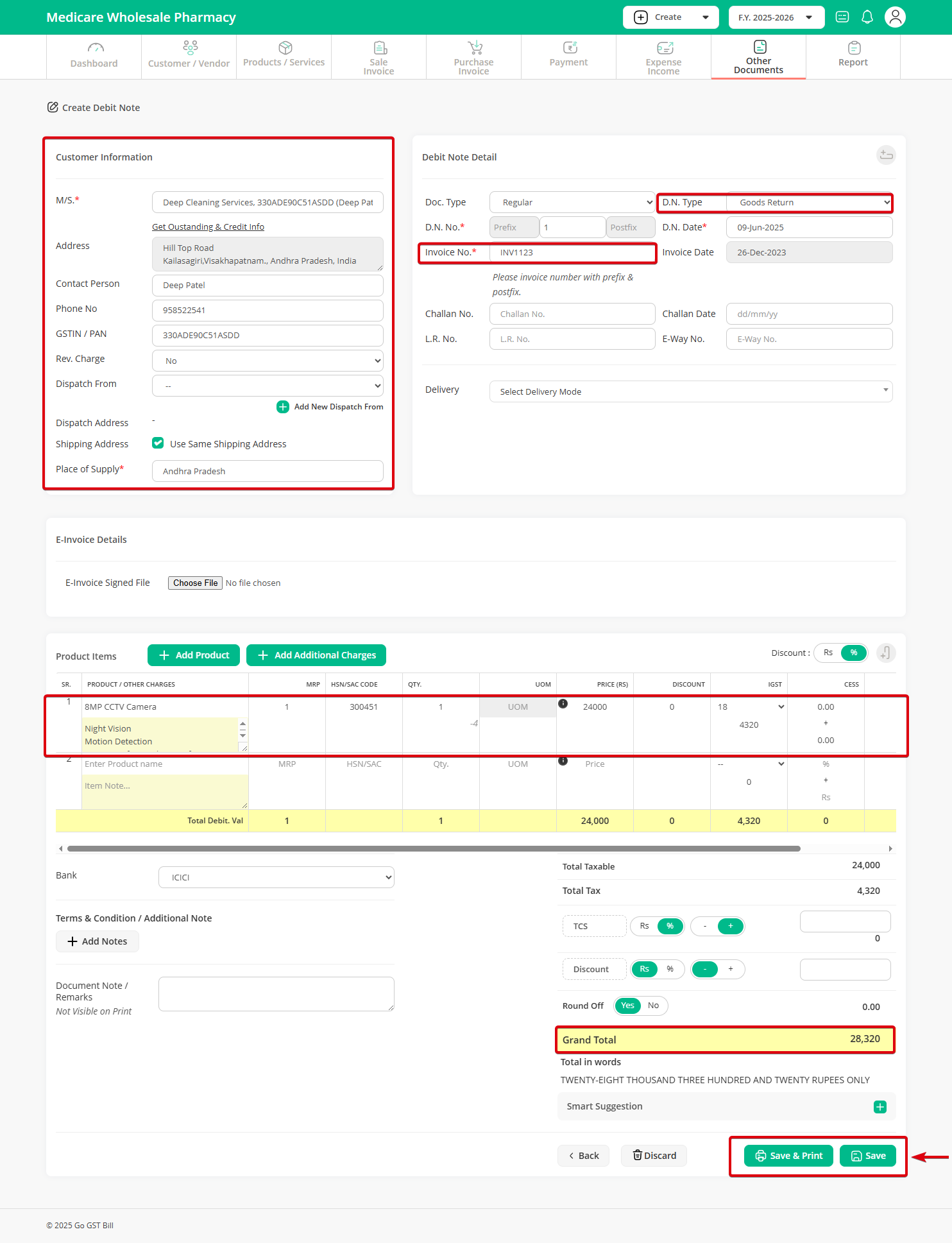

- Select the customer / vendor for whom you need to generate a debit note.

- Select debit note type.

- Enter invoice no against which you want to generate a debit note.

- Enter return product details and click on Save.

Method 2:

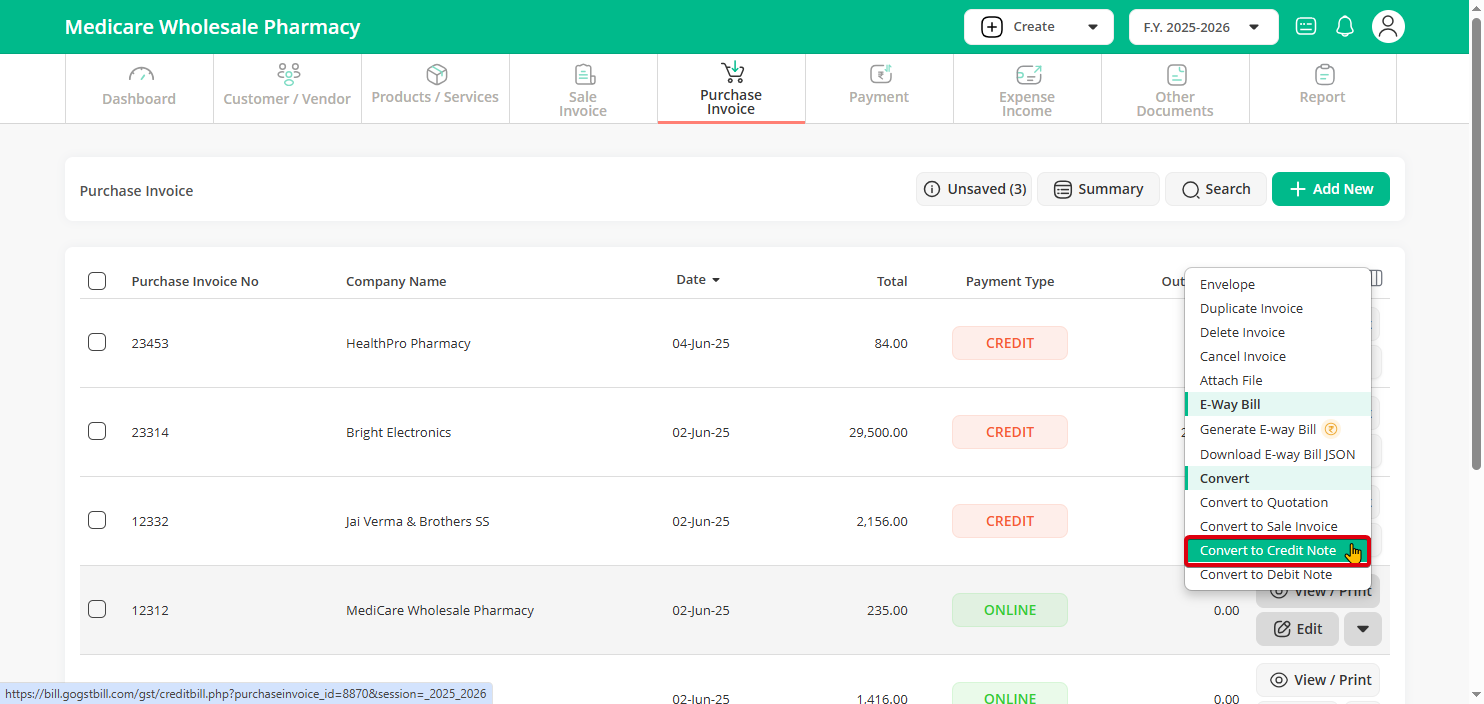

Step 1: On Purchase Invoice list page click on the down arrow beside the Edit button then click on the “Convert to Credit Note” option

Step 2: It will create a credit note and auto-fill all the details of a selected invoice, update return product detail and click on the “Save” button