Till date, the concept of GST is now very much clear among the people. A lot of deliberation occurred, but now with the recent amendment of GST the rates for different services and goods are finalized under various tax slabs. The general people of India are expecting that it fills the loopholes present in the current system. Doubtlessly, it comes into action for unifying the indirect taxes throughout the India.

Before knowing anything, you must be clear about the fact of GST registration. What are the rules to get registered and who can register under it? These are some important questions whose answers must be clear in your mind. You are also applicable under the GST if:

- Your turnover exceeds the cost of Rs. 20 lakhs in a financial year. The turnover is decreases up to 10 lakhs in case of special category states. Be assured that your turnover must contain the aggregate value of the taxable supplies, export of goods, services, interstate supplies and exempt supplies.

- If you are registered under the previous law, then you have to register yourself into GST also.

- In case a registered business was transferred to someone at that time also the transferee has to register under GST from the date of transfer.

- For the interstate supply of the goods and services, it is necessary to get registered.

- Non-resident taxable person.

- Supplier’s agent

- People paying tax under the mechanism of reverse change.

- Casual taxable person

- Those who are aggregator or operator of E-commerce.

- Input service distributor.

- Those who are in the business of supplying the online information and database access.

- People who are practice the supply via e-commerce aggregator.

Important points to emphasize on

GST registration is very important for the business class people. Here, we are mentioning some of the crucial points that should keep in mind when you are going for the GST registration.

- If you have multiple business verticals in a state, then you have to apply for the separate registration process for each vertical.

- Earlier than applying for the GST registration, your PAN is very mandatory. This condition is not applied for the non-resident person because they require different kinds of documents.

- In a condition when the registration gets rejected under CGST or SGST act, it still stands rejected for the reason of the SGST/CGST act.

Either it is short term or long term run, GST shows the impact on business person and customers as well. GST is appreciable for the simple process and change the look of the entire country. By removing the cascading tax effect, the smart act of GST intelligently defined the process for E-commerce and regulates the unorganized sector. Go GST Bill is a recognized organization who helps you in every step of GST registration process. We are here for your help and clarify all your doubts related to the GST. Exemplify all your doubts and enjoy the advantages of GST.

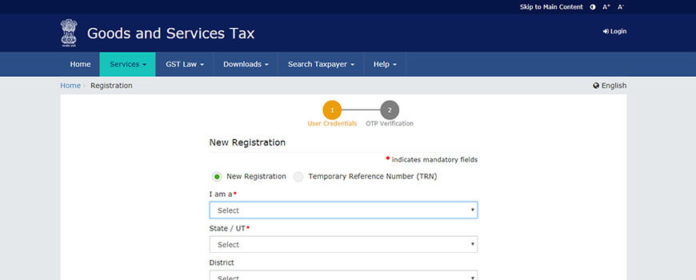

Refer Official GST website https://reg.gst.gov.in registration for online registration and more information about GST registration.