Compulsory E-Invoicing for Businesses with Annual Turnover Surpassing 5 Crores

Starting 1st August 2023, businesses with an aggregate annual turnover exceeding Rs. 5 crores will have to mandatorily opt for E-Invoicing for business-to-business transactions under the Goods and Services Tax (GST) as per the latest government announcement.

The below table reflects how thresholds for E-Invoice turnover limits have been reduced periodically:

| Date of mandatory implementation of E-Invoice | E-Invoicing annual turnover limit |

|---|---|

| 1st August 2023 | Rs. 5 crores |

| 1st October 2022 | Rs. 10 crores |

| 1st April 2022 | Rs. 20 crores |

| 1st April 2021 | Rs. 50 crores |

| 1st January 2021 | Rs. 100 crores |

| 1st October 2020 | Rs. 500 crores |

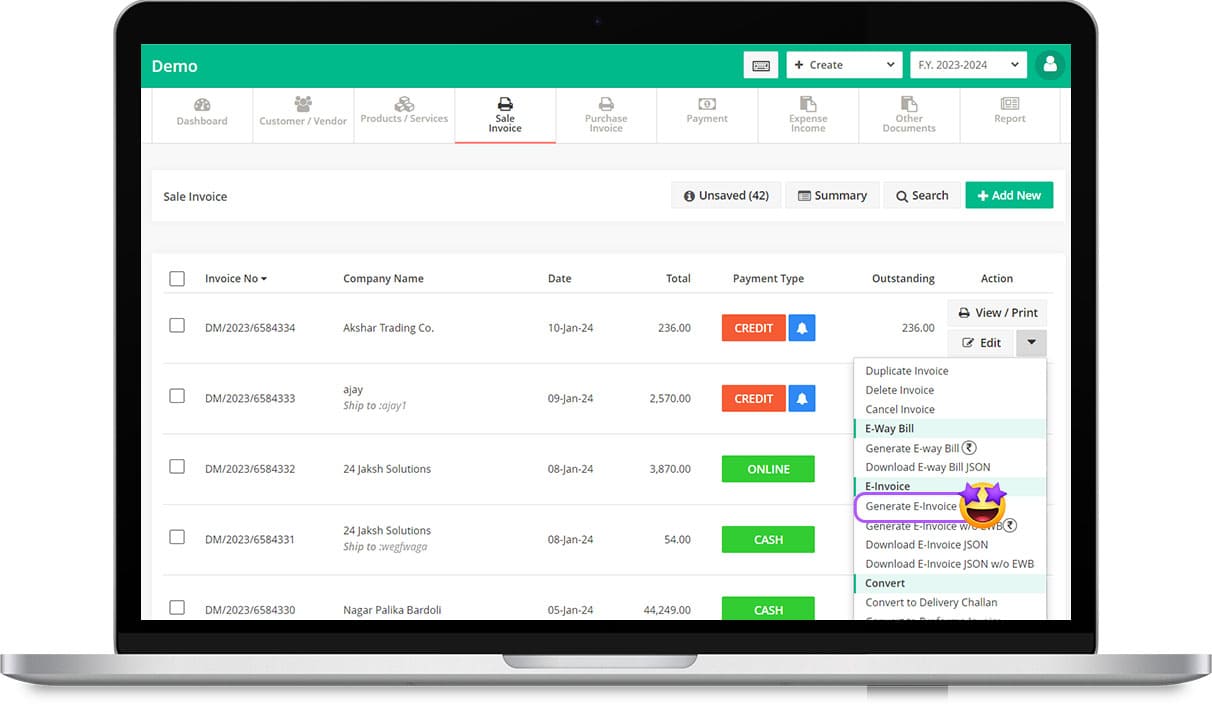

How to Generate E-Invoice Using Go GST Bill E-Invoice Software

Creating E-Invoices is super easy with Go GST Bill software! After creating your invoice, just click the “Generate E-Invoice” button to create the E-Invoice. It reduces the complexity of generating E-Invoices and makes the entire process easy and streamlined.

Benefits of generating E-Invoice using Go GST Bill

E-Invoicing software by Go GST Bill is the best E-Invoicing solution for businesses of any scale and industry. It ensures easy E-Invoices generation and reduces all the complexities of E-Invoicing.

Our Billing and E-Invoice software helps you to generate invoices conveniently and quickly, track payments, enhance compliance and manage invoices in an organised manner. It eliminates the need for paper invoices and human data entry, thus saving you a lot of time, energy and money.

- Very Simple To Use

- 1 Click E-Invoices Generation & Cancelation

- No Need To Go To E-Invoices Portal

- Easy Way To Share E-Invoices

- Smart Auto Validation

- Auto Add E-Invoices Detail On Invoice

What is E-Invoice under GST?

‘E-Invoicing’ or ‘electronic invoicing’ refers to a system introduced by the government in which all Business-to-Business (B2B) invoices along with a few other documents are electronically uploaded and authenticated by GSTN.

Once the authentication is done, each invoice is assigned a unique Invoice Reference Number (IRN) by the Invoice Registration Portal (IRP), which is managed by the GSTN. In addition, each invoice is digitally signed and affixed with a QR code. This entire procedure is referred to as E-Invoicing under GST.

An important thing to understand here is, E-Invoicing does not mean creating invoices directly on the GST portal, instead, it means submitting an already generated standard invoice on a common E-Invoice portal. This process automates various reporting requirements by entering invoice details just once.

What are the Benefits of E-Invoicing?

The main objective of introducing E-Invoicing is to make the invoicing process simpler, faster and more efficient. E-Invoicing eliminates the need for physical invoices, enabling a smooth flow of invoice data between businesses and tax authorities. It also facilitates in matching invoices between buyers and sellers and minimises instances of duplication and errors.

The invoice information further automatically gets transferred from this portal to both the GST portal and the e-way bill portal in real time. Since the information is directly passed, it eliminates the need for you to manually enter details when filing GSTR-1 returns and generating part-A of e-way bills.

Who is Eligible to Generate E-Invoices?

All GST-registered businesses with an aggregate annual turnover of Rs. 5 crores or more in any financial year from 2017-18 onward will need to generate E-Invoices. Businesses must prepare E-Invoices for taxable goods and services and credit/debit notes issued by them. It covers all B2B transactions, export transactions and special economic zone transactions.

Consequences of Non-Compliance with E-Invoicing Regulations

Failure to comply with E-Invoicing regulations within the stipulated period can attract severe fines and penalties.

- Penalty for non-issuance of invoice: Failure to issue or generate E-Invoice requires a business to pay Rs. 10,000 for every invoice not generated or 100% of the tax liability, whichever is more.

- Penalty for incorrect invoice: Failure to submit correct invoice details to the IRP requires a business to pay Rs. 25,000 for every incorrect invoice submitted.

Furthermore, non-compliance to E-Invoicing regulations can lead to adverse consequences such as:

- GSTR-1 may not get auto-filled with details of B2B sales.

- It can lead to non-generation of e-way bill. This can affect your logistics and cause delivery delays.

- Buyer will not be eligible to avail input tax credit. This can lead you your payment getting stuck and eventually affecting your working capital.

- Buyer may reject a non-compliant invoice. This can adversely affect the continuity of your business contracts.

Conclusion

With the latest amendment in the E-Invoicing threshold, it has brought many midsized and small businesses under its scope. If you too fall under the ambit of E-Invoicing, Go GST Bill can help you excel in the E-Invoicing realm and revolutionise your financial operations.

Get E-Invoicing ready with Go GST Bill.