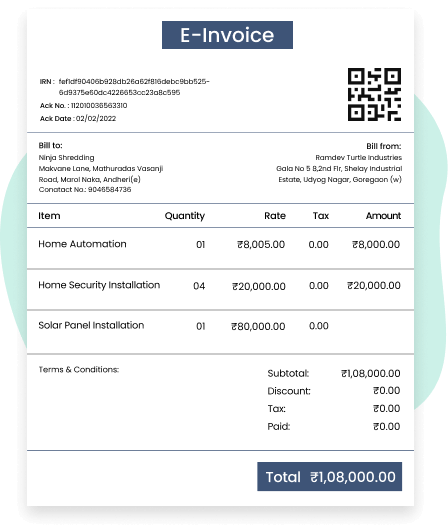

As per the latest government announcement, E-Invoicing is mandatory for all businesses whose aggregate annual turnover exceeds Rs. 5 crores.

You can generate E-Invoices on the official E-Invoices Portal (https://einvoice1.gst.gov.in) as well as using Go GST Bill.

Generating E-Invoices using Go GST Bill E-Invoicing software reduces the complexity of generating E-Invoices and makes the entire process easy and streamlined.

Go GST Bill is the best software for E-Invoicing.

Our cloud-based all-in-one E-Invoicing software simplifies E-Invoicing generation with user friendly interface and smart validations.

Go GST Bill E-Invoicing software is for all small, medium and large businesses with aggregate turnover exceeding Rs. 5 crores in a financial year.

Go GST Bill is fully GST-compliant and aims to simplify your E-Invoicing challenges.

Creating E-Invoices on Go GST Bill is very simple and quick. All you have to do is, make a regular invoice using Go GST Bill and then create an E-Invoice by clicking on generate E-Invoice button.

You cannot edit or modify the E-Invoice after creating it. However, you can cancel the E-Invoice within 24 hours of creation from Go GST Bill.

Yes, Using Go GST Bill you can share your E-Invoices with your customers on WhatsApp, by email or as an invoice link to make the invoicing process faster and more efficient.