Step 1 : Click on Purchase Invoice Menu and click on “Add New” Button

Step 2 : To create Purchase Invoice you have to enter details of your Vendor, invoice, product and payment.

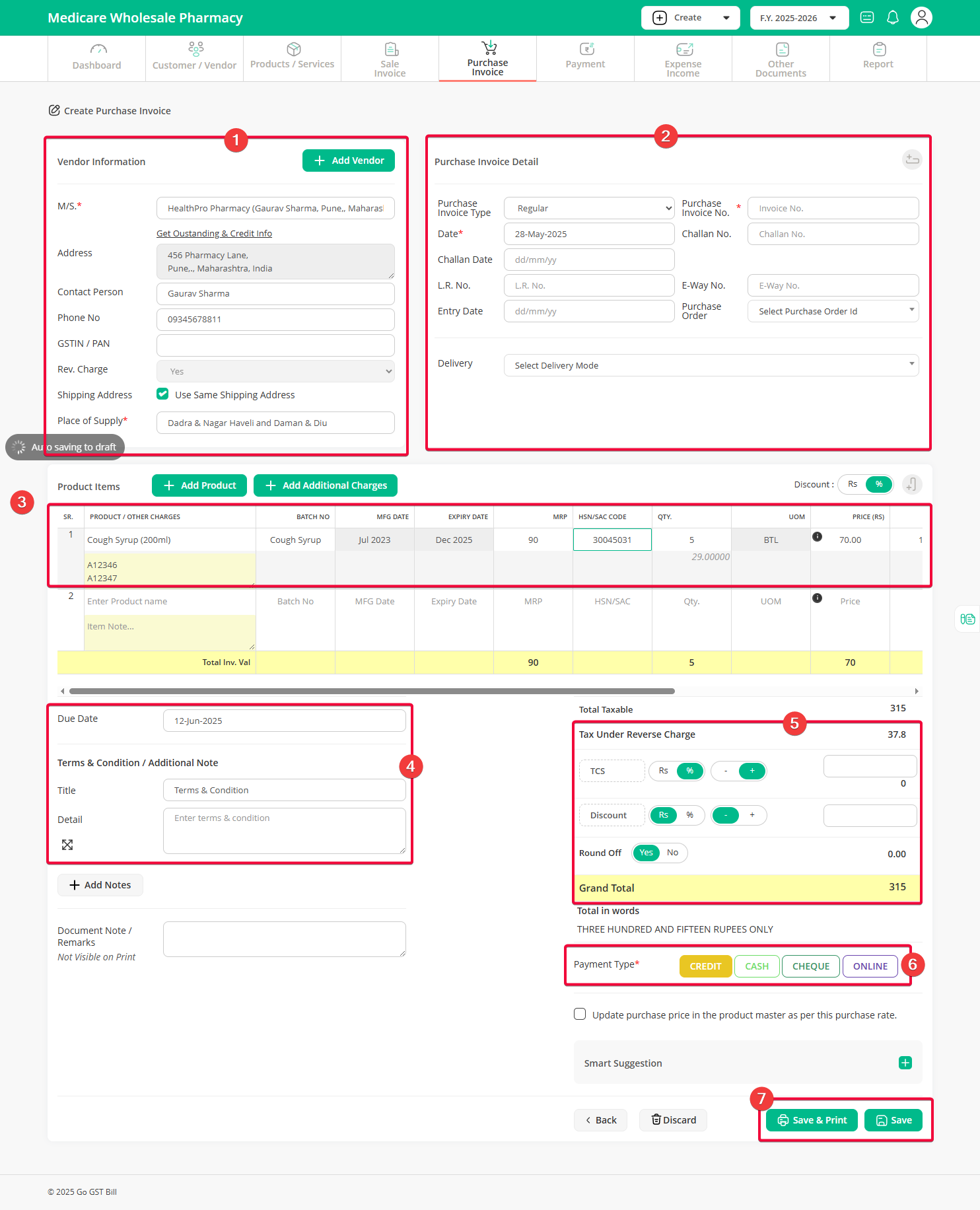

Section 1: Vendor Information Section:

– Select Vendor from the list or if you do not have that Vendor click on Add Vendor button to add new vendor

Section 2: Invoice Detail Section:

– Select Invoice Type : Regular, Bill of Supply, Export

– Enter invoice no as recieved from the vendor & Date will be auto selected but if needed you can change it

– Enter other information like Challan No, LR NO, Entry date (These fields are customizable from the settings)

Section 3: Product Items

– Select the Product from the list or if you have not added your product click on “Add Product” button to add a new product

– Other details like HSN, QTY, UOM, Price, GST will be auto-filled based on what you have entered when creating a product. If needed you can edit it or add if it’s blank.

(Enter Price and select GST if your Purchase price is excluding, Or if your price is including then select GST and enter Total amount it will auto calculate Price)

– Select all the products that you want to add to the purchase invoice

(You can use “-” button to remove any product, and use “+” button if you want to add a new item in between already added items)

Note: You can change the Discount in Rs or % from the discount toggle button

Note: If you want to add extra changes like Packaging, Transport you can add that by clicking on “Add Additional Charges” and then you have to add those charges in the invoice, the same way as you added items

Section 4:

– Select the Due date if you are creating the bill on credit

(Note: If you want to set the default due days, you can set it in the settings option)

-Enter Terms & Conditions as per your received invoice but its optional so you can skip

– If you want to add any extra notes you can add that by clicking the “Add Notes” button

Section 5:

– You can add TCS or discount if needed

Note: Both fields are customizable, you can change their label and function if you want to add that amount to the total amount or subtract from the total amount

Example: you can change the Discount name to Subsidy and click the “-” button and “%” button so it will subtract the entered % from the total amount.

– Set Round off to Yes or No as per your need

Step 6: Select the Payment Type Credit, Cash, Cheque, or Online

Credit will mark the invoice as unpaid, If you have selected Cash, Cheque or Online enter the amount paid by you and payment note for your reference (payment note will not be printed on the invoice)

Note: If you have saved the invoice with Credit and after that, if you want to add payment then you have to create a Payment Receipt

-If you have given any advance payment to that vendor it will show option to adjust advance payment. click Yes if you want to adjust that amount with this purchase invoice.

Step 7 :

– You can add any remark in the Document note section (it’s for internal use and will not be printed in the invoice)

Example: like who created this invoice

– Click on update purchase price to update the product master as per the current purchase rate

Step 8 : Save your invoice by clicking the “Save” button or “Save & Print”

Click on the Discard button if you do not want to save this invoice.